In the time it takes you to read the beginning of this post, one out of every 20 people will have checked their mobile phone. We use our phones for communication, looking up things on the Internet, social media, GPS and so much more. It only makes sense that we would start using them to handle payments. This new generation of apps that are used for mobile payments is steadily becoming more and more popular and relevant.

Mobile Payment Apps

Mobile Payment Apps

If you’re not familiar with mobile payments, I’ll fill you in. There are several mobile payment apps, like PayPal, Popmoney, Dwolla, and more. Most of these can be used for both person-to-person payments or for business-to-consumer payments. Some are free for transactions, like PayPal, and some charge a small fee for transactions.

One thing that all the mobile payment apps have in common, though, is that they make it easier to pay from your phone. They allow you to send money to friends, family or businesses with practically one ‘click’. Once you have your funding source connected, it is easy to connect with contacts and pay who you are trying to pay. Usually, you only need someone’s phone number or email. These mobile payments eliminate the hassle of depositing checks, or driving to an ATM to take out cash. They also keep your banking information secure. Making payments has been simplified. However, some companies are taking the idea of mobile payments one step further: making them social.

Social Mobile Payments

One mobile payment app that has taken the lead on becoming social is Venmo. According to co-founder Iqram Magdon-Ismail, the goal for the app is “to be accepted like Visa and used like Facebook.”

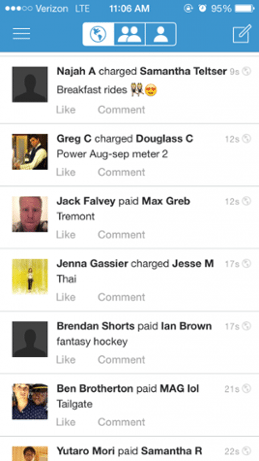

On the app’s home screen (seen right), you will see a feed of transactions between your friends and contacts (or a public feed, if you choose). The feed includes who paid who, when the transaction was made, and what the transaction was for, which is written by the user.

The feed never includes how much the transaction was for, and users have the option of deciding who sees their transactions, if anyone. This creates a mobile payment app that is used like Twitter or Facebook. You can even like or comment on transactions. For some, this app may seem like an invasion of privacy. For others, a new social media platform is an exciting way to interact with friends (even if it does involve paying them back).

Now that Venmo has started the trend, others are soon to follow, and Facebook may be the first. According to screenshots by a computer science student, Andrew Aude, it seems that the mobile payment capabilities are already built in into the new Facebook Messenger app. This could mean that while connecting and communicating with friends in a social way, you could also send payments as easily as you would send a message or an emoji.

We are sure to see this trend of social mobile payments grow, as we have seen social media grow exponentially in the past few years. Stay tuned for more mobile payment updates from Facebook, and most likely the other social media giants as well.