According to Investor’s Business Daily, financial advisors who are active on social media gain an average of $4.9 million in assets under management (AUM).

That’s an AUM increase of 4.9 million dollars. Because of social media.

As we’ve discussed before in this blog, social media is a big part of inbound marketing. Through social media, you’re able to attract strangers to your business and turn them into visitors, leads, customers, and, eventually, promoters of your business.

Social media helps you understand your target audience, boost your SEO efforts, and help you manage your business’s reputation.

It’s where you go to interact with your current clients as well as potential customers; where you can get personal and show that there’s a face behind the brand.

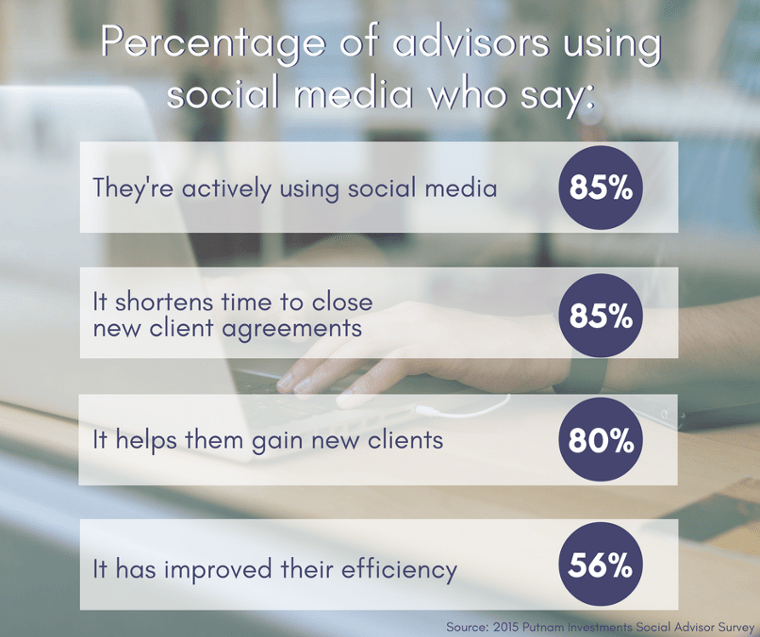

Putnam Investments recently surveyed financial advisors and found out the following information about how social media has impacted their business:

So where do you start?

We know there are a lot of social networking platforms out there, but not all of them are right for your business. So, before you go sign up for 10 different profiles, let me talk about which ones would be best for the type of customer you are trying to reach.

LinkedIn is a social networking platform that allows users to create profiles that describe their work experience, education, and training, and then connect with similar users. LinkedIn is often used by employers to list jobs and search for potential candidates.

Posting to LinkedIn is similar to that of Facebook, though considered more professional and business-oriented. Users may also post mini-blogs called Pulse posts that can be circulated throughout LinkedIn’s user base.

While IBD found that 73% of financial advisors use LinkedIn, they don’t use it as often as they do Facebook or Twitter.

Even though it is not used as often, it shouldn’t be neglected. LinkedIn is a great platform for advisors to find successful professionals who fit their target demographic, for example, people in need of retirement planning or small business owners. Connections with those people through LinkedIn can show the human side of a financial advisor’s business, and in turn help close a deal.

Practical Uses

- Publish business-centric posts that target your solutions to the problems people may have.

- Repurpose your blogs by publishing them as Pulse posts.

- Connect with people in your industry and have an optimized profile to show your authority.

- Connect with people who fit your buyer persona.

Facebook is a social media giant with nearly 2 billion active daily users. For businesses, Facebook is a place to build up a follower base, increase visibility, improve branding, and communicate and engage with customers.

To learn more about getting the most out of Facebook, check out this blog.

Facebook is the second most popular social site for advisors, behind LinkedIn, but it is used more often. On average, advisors visit Facebook 23 times per month.

Practical Uses:

- Engage with your current followers and attract new ones.

- Use Facebook ads to reach your target customer.

- Share your company’s blogs and other news.

Twitter is a social networking platform that allows users to send and read short 140-character Tweets and boasts around 310 million monthly active users.

Twitter is best-known for organizing Tweets using hashtags (#). When you put a (#) in front of a word or phrase (without spaces), Twitter indexes those into a single feed that you can search for and scroll through.

Twitter ranks around the same as Facebook with advisors; on average advisors use this platform around 21 times monthly, still more than LinkedIn.

Practical Uses

- Use industry-related hashtags to allow your Tweets to be found by those searching.

- Post news and blogs about the industry, as well as retweet related items.

- Follow similar accounts and help boost your authority in the financial industry.

In order to incorporate social media into your inbound marketing strategy correctly, you must make sure you are using the platforms your target audience is using.

While cases can be made for many other social networking sites, you’ll want to use the ones that have the most potential to help you reach the most people in your target audience. For financial advisors, this means having a presence on Facebook, Twitter, and LinkedIn.